Compliance for custom-developed accounting systems

Even if your current ERP system is not on the list of pre-approved systems, there is no need to switch to a new ERP system.

With compliance from Digisense, your current ERP system can be transformed to meet the new accounting law within a few hours - significantly cheaper and faster than switching to a new system. And you thus maintain your current setup.

See an example of how it went for David Superlight in Ugeavisen here.

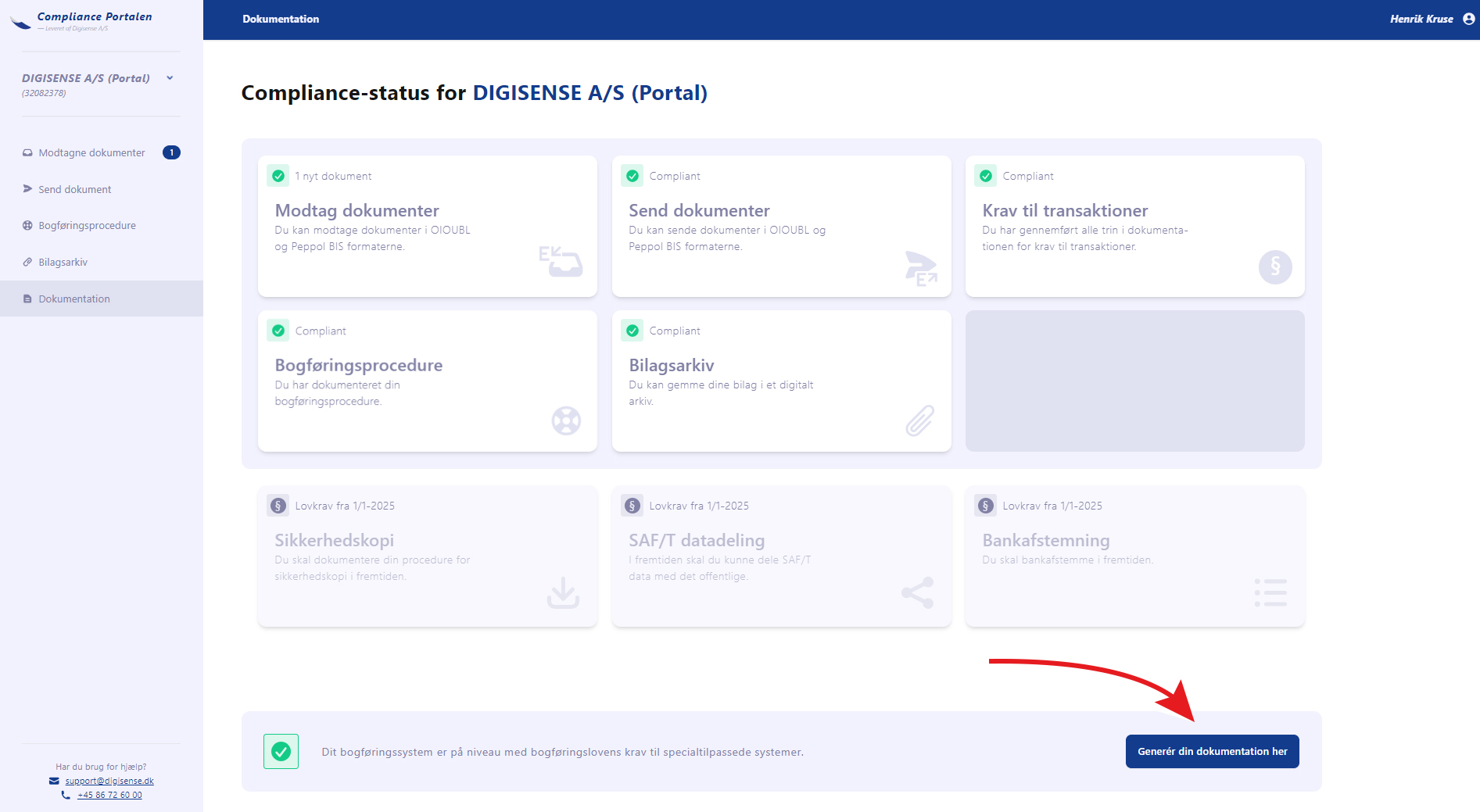

This is how the compliance portal works

Once you have gained access to your compliance portal, it will contain all the functions/modules (see package above) you need to comply with the requirements for non-registered bookkeeping systems in Denmark and become compliant with the Bookkeeping Act.The red arrow indicates where you can retrieve your documentation on compliance with the new bookkeeping act with a single click.

You will find a complete video guide on the Bookkeeping Act, documentation, and the customization of all modules in the PDF guide, which you can download here.

You will find a complete video guide on the Bookkeeping Act, documentation, and the customization of all modules in the PDF guide, which you can download here.

Introduction to the Compliance Portal - Step 1

Guidance on bringing the company's existing bookkeeping system up to par with the requirements of the Bookkeeping Act.

Onboarding on the Compliance Portal - Step 2

See how to access and use the compliance portal. Guidance on bringing the company's existing bookkeeping system up to the requirements of the Bookkeeping Act, through access to the Compliance Portal.